Florida's homeowners insurance landscape has become at a frenetic pace, making it more essential than ever for residents to comprehend the nuances of coverage in 2025. Emerging regulations, skyrocketing claims costs, and extreme weather events all play a role into this complex environment. This means homeowners need to be informed in their pursuit for the best coverage.

- Here are some factors to keep in mind:

- Coverage options: Investigate the different types of coverage available, like dwelling coverage, personal property coverage, and liability protection.

- Flood insurance: Given Florida's exposure to hurricanes and rising sea levels, flood insurance is often a must-have of a comprehensive homeowners policy.

- Out-of-pocket expenses: Understand the different deductible options and their effect on your monthly premiums and out-of-pocket costs in case of a claim.

- Monthly payments: Evaluate quotes from different providers to find the most cost-effective option for your needs.

Staying well-versed about changes in the Florida homeowners insurance market can help you arrive at the best decisions to protect your property.

Understanding 2025 Coverage Clarity: Your Florida Homeowner's Insurance Breakdown.

As we approach that pivotal year of 2025, policyholders across the Sunshine State are facing a landscape evolving rapidly. New legislation and challenges within the insurance market are creating confusion about what policies will be available and how much they will cost. To make informed decisions for your future, it's crucial to understand the significant developments taking place.

This article will present you with a concise breakdown of the future homeowner's insurance market in Florida, helping you to make sense the shifting landscape and make informed decisions for your peace of mind .

Navigating Florida Homeowners Insurance: Essentials for 2025

Florida homeowners insurance is a dynamic and often complex landscape. As we move 2025, several key factors impact the financial burden of coverage. Increasing insurance rates continue, driven by forces such as severe weather events. List my home Fort Lauderdale

Understanding your policy terms is crucial to guaranteeing adequate protection. Review your coverage thresholds, deductibles, and exclusions. Consider parameters like property age when determining your needs.

In 2025, Florida homeowners should intentionally investigate multiple insurance quotes to compare different alternatives. Communicate with reputable insurance agents or brokers who focus in Florida coverage.

Florida Homeowner's Insurance: What to Expect in 2025

As we venture into 2025, homeowners across sunny Sunshine State are likely pondering about the future of homeowner's insurance. With a history of dynamic rates and policies, it's more important than ever to be in-the-know. The Listing Team is here to shed light on what homeowners can prepare for in the coming year.

One key factor shaping 2025 homeowner's insurance will be the increasing impact of climate change. Florida, as a state vulnerable to severe weather events like hurricanes and floods, may see further rise in insurance premiums.

- Additionally, homeowners can anticipate advanced tools being implemented within the industry.

- Such advancements could potentially reduce risk, ultimately benefiting homeowners in the long run.

Navigating Florida's Shifting Insurance Landscape: A Guide to 2025 Coverage.

Florida's insurance market is rapidly adapting, presenting both obstacles and benefits for policyholders. As we venture into 2025, it's crucial to grasp the ongoing landscape and steer a course for suitable coverage. Herein article outlines key factors shaping Florida's insurance future, delivering valuable knowledge to help you obtain the coverage you need.

- Firstly, consider the impact of climate change on Florida's insurance market.

- Second

- ,Lastly, consider the role of innovative solutions in shaping the future of Florida insurance.

By

Are you a homeowner in the Sunshine State worried about the fluctuating landscape of homeowners insurance in Florida? As we approach 2025, understanding the new regulations and policies is essential. The Listing Team is here to guide you through the complexities and confirm your Florida home remains firmly protected. With our expertise in state-specific insurance, we can help you find the best coverage options accessible for your needs and budget.

- Reach out to The Listing Team today for a complimentary consultation.

- Discover how we can customize your homeowners insurance policy to meet the unique requirements of your property.

- Don't wait until it's too late. Make control of your homeowners insurance future with The Listing Team.

Ariana Richards Then & Now!

Ariana Richards Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Barbara Eden Then & Now!

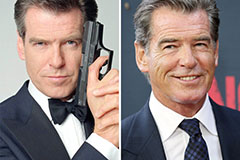

Barbara Eden Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!